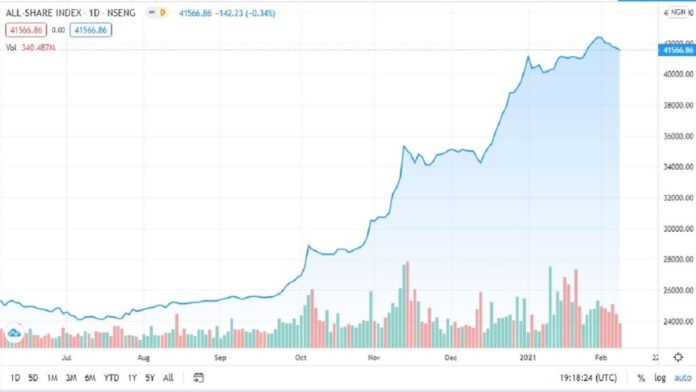

The equities segment of the Nigerian Stock Exchange records a negative start in the week as market capitalisation drops by ₦74.4 billion following the Central Bank restriction on cryptocurrencies trading.

At the close of trade, the domestic equities market posted a bearish performance as the All-Share index declined 34 basis points (bps) to 41,564.31 points.

The decline in stock market value came as a result of profit-taking in GUARANTY (-8.8%), PZ (-9.7%), and CHAMPION (-9.8%).

Consequently, year to date return declined to 3.2% while market capitalisation settled at ₦21.7 trillion.

Market data shows that activity level waned as volume and value traded fell 29.4% and 52.7% respectively to 340.3 million units and ₦2.6 billion.

The most traded stocks by volume were UBN (78.8 million units), FBNH (54.2 million units) and ACCESS (34.0 million units)

Meanwhile UBN (₦457.1 million), FBNH (₦396.4 million) and ZENITH (₦368.6 million) led by value.

Afrinvest said performance across sectors under its coverage was bearish as 4 of 6 indices closed southward.

The Banking index lost the most, down 2.7% due to profit taking in GUARANTY (-8.8%), JAIZBANK (-9.7%) and WEMABANK (-5.8%).

Similarly, sell-offs in CORNERSTONE (-9.2%), AIICO (-2.5%), PZ (-9.7%) and CHAMPION (-9.8%) dragged the Insurance and Consumer Goods indices lower by 0.8% and 0.3% respectively.

The Oil & Gas index also declined 1bp due to price weakness in ETERNA (-0.9%).

On the flip side, the Industrial Goods index was the lone gainer, up 5 bps due to price appreciation in WAPCO (+0.8%) as the AFR-ICT index closed flat.

Investor sentiment as measured by market breadth increased to 1.3x from the 0.4x recorded previously as 21 stocks gained against 16 losers.

MCNICHOLS (+9.6%), UPDCREIT (+9.1%) and MULTIVERSE (+8.3%) were the top gainers while CHAMPION (-9.7%), PZ (-9.7%) and JAIZBANK (-9.7%) were the top losers.

“In the next trading session, we expect to see slight profit taking in high-priced stock”, Afrinvest stated.